The Ontario MicroFIT program is a keg about to run dry. Nobody knows if there’s another keg in the cellar. The Ontario Power Authority isn’t saying. There are encouraging signs, but past experience has taught us to be pessimistic.

We’ve been here once before. In October of 2011, following a provincial election, the program was shut down for a review of policies, procedures, and pricing. There was no advance warning that the stoppage was pending. There were few signs of how long the program would be closed, and what few there were turned out to be grossly understated. The industry was taken completely off guard, and was shoved into an extremely damaging nine-month deep freeze.

Things are different this time around – to a point. At least now there is some advance warning that something lies ahead, thanks to a feature of MicroFIT 2.0 called the Annual Procurement Target. The OPA indicated that the target for 2012 would be 50 MW. However, they haven’t really defined what that means. The industry has been forced to infer the meaning from the OPA’s behaviour.

When an aspiring MicroFIT participant applies for a contract, the OPA checks the application against the target. If the capacity of the proposed project falls within the target (and assuming the rest of the application is in order), the OPA gives conditional approval. Then the applicant must apply to their local utility for a connection.

No application has yet been rejected because it exceeded the target. Every MicroFIT project is roughly the same size – 10 kW – so once a project exceeds the cap, so will every project that comes after. The target is a trigger to turn off the taps until…something.

Back in late December, there was some speculation about the meaning of the word “Annual”. Did it refer to a target for calendar 2012? Some (me included) supposed that if the 50MW tranche was completely contracted out before New Year’s Day, the program would be shut down until the start of 2013, at which time another annual target would be set. Over 15MW remained when the calendars flipped, so we’ll never know what would have happened.

The OPA issued an update on December 21st,, but it shed little light. It implied that applications submitted before the end of the year would “remain active”, whatever that means. It suggested that anything submitted after that date would be subject so some as-yet unspecified pricing. It promised that more details regarding 2013 pricing would be released in 2013.

When 2013 started, The OPA kept on working through the remaining 15 MW, putting to rest any speculation that a new annual target would be set. That, at least, was comforting – it was evident that the program was not going to be shut down, at least not for a little while. However, there was no explicit statement that the existing pricing would remain in effect. This left the industry flying blind, not knowing if the projects they were pursuing would be subject to the existing price, or one yet to be revealed. This did not make for comfortable customer relationships. “Here, buy this system. It will earn you money. We have no idea how much. Hello? Hello?”

The OPA waited until January 29th to clarify things. At that time they announced that until the 50MW was exhausted, the existing pricing would remain in effect. That, finally, brought some clarity. However, it was also clear that at the established rate of contract issuance, only a few weeks remained before the procurement target (they stopped using the term “annual” at this time) would be reached and… something would happen. A price decrease? Probably. A complete shutdown? Maybe. There was a bit more transparency than back on October of 2011, but still far too much fog.

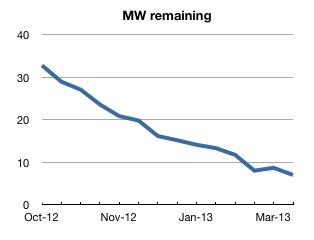

One thing that was clear: The amount of capacity allocated each biweekly period was between two and three megawatts, which meant that as of the end of January there were between two and three months left before the procurement target would be reached. On April Fools’ Day or May Day or somewhere in between, the keg would be empty.

When the barkeep announces last call, what to patrons do? They stampede for the bar to grab their last pint. Or two. This is what happened. The period from February 18th to March 4th saw a big uptick – only once in October did the biweekly report show a steeper drop in remaining capacity. The target was drawing nearer even faster than expected.

Then something odd happened. Over the following biweekly, the unallocated capacity actually increased. This is puzzling at first, until you realize that any approved project has 180 days to get installed and connected. The rush of applications that came after the program reopened in July – many of which replaced ones that died on the vine when the October 2011 program review was announced – were bumping into that six month limit, and clearly plenty had missed their deadline. It is to the OPA’s credit that they re-released this capacity into the pool to be reallocated, instead of treating it as spent.

Now the influx of new approvals and the amount of offsetting expirations should be approaching equilibrium, so we can expect the remaining capacity to continue to drop by about two megawatts per biweekly period. That means that as of this writing, the best guess is that the procurement target will be hit around May Two-Four.

The OPA still hasn’t said what it plans to do when the keg is empty. However, last month it launched a consultation process to various stakeholders – industry associations, representatives of electricity consumers, and community groups. The review was focused on one thing – price.

This is actually encouraging. Remember that the last time the OPA did a review, they shut the entire program down for the better part of a year. This time it looks like they don’t plan to shoo everyone out of the bar and bolt to door; rather, they’re chatting with folks while the taps are still running.

Yes, it does look like another price drop is likely. That’s okay. The industry can take it. Solar module prices have continued to drop since the July re-launch. That said, some of that price drop is structural – efficiencies gained by economies of scale as the industry has grown – but some is also cyclical, as overproduction has produced a glut of panels on the market. Once that excess inventory is drawn down, panel prices will stabilize and maybe even increase. If the OPA lowers the rate too much, they risk making the program unattractive. That will not be in anyone’s best interests.

But it’s much better than shutting things down.

So here’s to the OPA rolling out the next keg – and may it be tasty, frothy, sensibly priced, and bring us all courage to keep pressing on toward a greener, cleaner tomorrow.